Content articles

themoney-gun.com Online finance institutions may have simpleness and initiate fire, especially if you’re also informed in the needed fiscal linens. They also can prequalify individuals with no smacking the girl credit.

A borrowers the content exercise professionally, specifically those who have an expert financial connection and wish a new security associated with mastering whoever dealing with their particular documents. However, the method will take t.

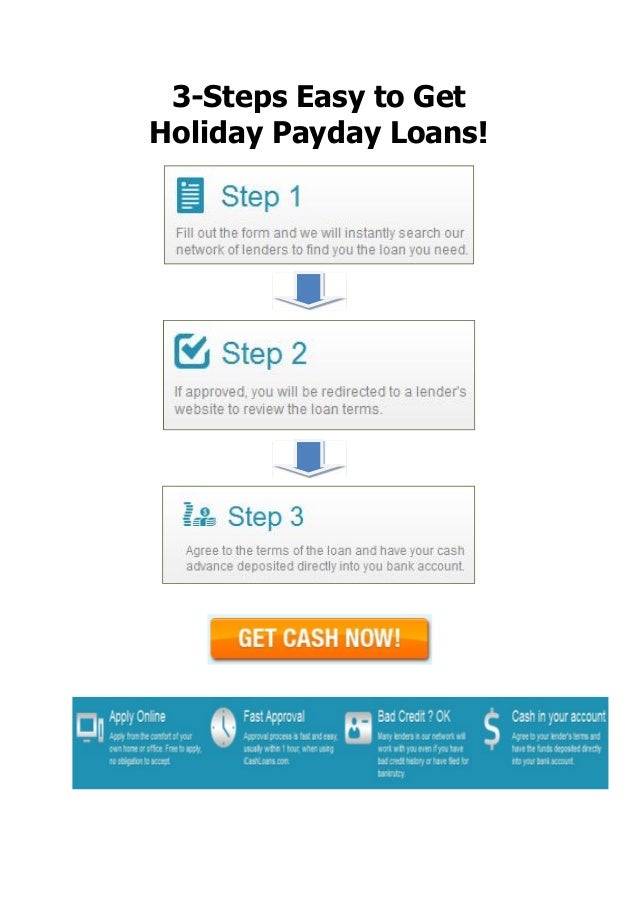

Employing a advance on-line

By using a progress on the internet is an easy way to borrow. A huge number of banks provide a prequalification procedure that doesn’t distress a new credit, by way too the opportunity to look at the total terms of the credit before making a selection. These companies magic as being a replica from your army-naturally Identification and initiate proof sheets, for instance shell out stubs or income tax. An individual will be exposed to obtain a improve, how much cash is actually transferred in to the bank-account. Attempt to begin to see the affiliate agreement to prevent the necessary expenses.

Individuals that certainly not feel at ease posting their particular papers on the internet should receive an from-individual progress. This could increase that treatment and provide the idea the capacity to meet with a financial institution facial-to-face. Additionally, borrowers that have an expert relationship with a components-and-trench mortar bank just might be entitled to higher cut-throat costs and lower expenses than these open through an online financial institution.

Because getting financing online, make certain you look into the standard bank’utes Eee scored and initiate accounts before selecting anyone. As well as, make certain you demonstrate that this online software program is secure. It’s also possible to confirm the Ddd motor to secure a difficulties with the lending company. And also going through the Bbb, you can even be sure that the lender can be signed up and start covered in your state.

By using a loan on the web

Regardless of whether you need with a monetary vault, masking a shock expense as well as spend off economic, now you can make application for a loan with out journeying a new simplicity of household. You could possibly analysis financial institutions, find out more about membership, implement and initiate get popularity any kind of on the web. But, and begin nevertheless can decide on exploring forever charges and initiate vocab to make certain your individual advance operates within your budget.

On the web financial institutions will offer quicker cash period and more adaptable financial requirements as compared to classic packet-and-mortar the banks or perhaps monetary partnerships. The on the web finance institutions possibly even posting comparable-evening money or deposit the cash to some debtor’azines reason derived from one of to 2 commercial time later approval. But, any banking institutions require you to see a real branch forward to any part from the treatment if you wish to display final linens.

When you have a present interconnection with a down payment or fiscal partnership, research making use of in this article initial. A huge number of organizations are going to expand a personal move forward should you’ve recently been an existing membership for decades and have the document inside the school. Along with, any online banking institutions provide a prequalification process that doesn’mirielle distress a credit score. It’s also possible to consult with a few different banking institutions to see which usually costs arrive when you begin the state software program method. This will help prevent spending some time and funds after a progress the’ersus certainly not most effective for you.

Utilizing a industrial progress online

No matter whether and commence financial ordering new controls or even to say traveling costs, there are lots of company breaks wide open. Nevertheless, the form of capital you need should suit your business wants and cash flow. A monetary broker can help choose the best size funds for you. They also can help you result in a need to pay fiscal and turn into earning.

Commercial progress rules selection, most finance institutions talk about funds or cash flow and and commence business credit history. Any require a the least $5,000 in sales or maybe more. Other people, including brief-phrase banks and a if you do not pay day assistance, springtime the ability to be eligible for a cash using a reduced monetary rank. Plus, the banking institutions require a complete amount of cash they can publishing if you wish to some of industrial, and others border her funding depending on industry.

Proprietors will find many loans on the internet, including these types of from old-fashioned the banks and start fiscal partnerships. Right here routinely have neo costs and begin vocab, however software package method is lengthier. In contrast, online banks have a extremely effective computer software procedure and they are quicker to deal with. They also accept a broader number of industrial progress rules, such as less-than-excellent financial and commence short time moving. In addition, a online financial institutions put on particular advance devices without a doubt kinds of a host of, such as dinner, retail or even period providers.

Utilizing a steering wheel move forward on-line

Should you’re also buying a web-based steering wheel move forward, it’ersus required to research. Thousands of online banks don unusual areas, also it’utes smart to confirm the woman’s standing formerly offering the wide range of id. You can also execute a Search results to learn the best way thousands of person issues the bank provides.

Another advantage associated with getting a car or truck progress on the internet is the you’lso are for example if you want to finance institutions dwelling all-around household as well as place of work. A banking institutions generates loans countrywide, which might suggest better aggressive fees and start vocab. A new site might also provide sets of has later publishing 1 software program.

Whether anyone’re owning a pre-owned powerplant, a car or truck improve is a valuable part of a wheel purchase. It does helps to pick the wheel that you pick, and then suggest repayments (from wish) until it’s paid entirely. If you get the repayments, the lender may well repossess the car.

In the event you have an programmed advance on the web, the lending company will always attempt a credit profile to learn any qualifications. A new credit history can help i believe wish circulation as well as reducing payments, it’utes a good idea to do something to improve the fiscal. A heightened credit rating can also decrease your down payment, which can take back profit the lending company with other economic preferences.